Category Archive: COVID-19

This is a restricted post COVID Member’s Briefing 08/07/2022

With Covid numbers on the rise again here is a reminder of the Scottish Government’s guidance if someone tests positive for covid or has covid symptoms: Coronavirus (COVID-19) | NHS inform

So, it’s recommended rather than mandated that people stay at home for 5 days from testing or the day symptoms started, and stay off beyond that if they have a fever or don’t feel well. However, the company also has responsibilities under the Health & Safety at Work Act for the safety of all employees in the workplace. The significant concern is about the transmission and the potential for lack of control over the spread and harm to those with existing health issues.

In practical terms, many of our member companies have indicated that they are not completely comfortable in allowing people into work who test positive, or who have symptoms. We would suggest that companies have a set of rules surrounding COVID such that there are rules about attendance and there is also some support to allow people to deal with symptoms, and the ability to self-isolate. Subject to proof of a positive test it would be reasonable to encourage or require that employees with covid do not come to work and that they are paid for that time (now downgraded to 5 days or when an employee’s temperature and symptoms abate). This levels the playing field between those who can and who cannot work from home. For those who pay full company sick pay, this certainly makes sense. Those who only pay SSP will have a decision to make, but it may be hard to persuade people who only receive SSP to remain absent if they feel well enough to work despite having Covid.

Companies will also have to consider how they treat the resultant absence – will it count for totting up absences or redundancy assessments?

If you would like to discuss this further please call the Legal & HR Team on 0141 221 3181.

Changes to COVID-19 rules and regulations 02/05/2022

Members should be aware that the rules surrounding COVID, and in particular around self-isolation have changed. Similarly, testing for the general population has ended. Government advice for those with COVID symptoms is to stay at home and avoid contact with others. This has reduced from a legal requirement to advice. Patently transmission of COVID within the workplace remains a risk, especially when those who have symptoms and cannot work from home come into work. Employers should therefore consider how to approach the ongoing management and risk of outbreaks of COVID within the workplace. Employers can continue to operate with any measures that they deem appropriate, and should update risk assessments accordingly. If you have any further questions, the team will be happy to help. Contact us on 0141 221 3181.

Member’s Briefing – Ensure your Section 1 Statements are compliant

Return to the Office Refresher – Ensure your Section 1 Statements are compliant

All employees and workers (with any length of service) commencing work from 6th April 2020 must be issued with a written statement outlining their employment particulars. This is referred to commonly as a ‘section 1 statement’ as the legislation which requires this is section 1 of the Employment Rights Act 1996. This should be provided before employment commencing or on the date it commences. Â

What are the changes?Â

Now that work from home guidance has been relaxed and many will be returning to the office after working from home for over 2 years, we would like to remind our member companies of the April 2020 changes in rules in relation to section 1 statements. It is a good time to review your statements, as in the landscape of the pandemic these changes may have been missed.Â

To make sure your section 1 statements are compliant with the changes imposed, please ensure they now include the below:Â Â

- The days of the week the worker is required to work, whether the working hours may be variable and how any variation will be determined.Â

- Any other paid leave to which the worker is entitled. This includes things such as maternity or paternity leave, parental bereavement leave, shared parental leave, and adoption leave.Â

- Details of any benefits provided by the employer that are not already included in the statement. If there are no benefits, this should also be expressed in the statement.Â

- Any probationary period that applies, including any conditions and the duration.Â

- Any training entitlement provided by the employer, including any training that is mandatory and any training that the worker must bear the cost of.Â

Other important considerationsÂ

Since April 2020, these statements must now be given to workers as well as employees. This includes agency workers, casual workers, and zero-hours workers. Formerly, an employer had two months from the start of an employee’s employment to provide the employee with a section 1 statement. This is now a day one right.Â

What do we need to do?Â

Please review your statement of employment particulars and ensure the points above are included. In the event you have any employees who started after this date that do not have statements containing the above, then you must provide them with one which complies within one month of any request. There is no need to amend the statements of employees and workers who started prior to the changes coming into effect on 6th April 2020. Â

Are there any risks of not complying with the new changes?Â

An employee cannot bring a solo claim for failure to provide a section 1 statement to the employment tribunal. However, they may raise a section 1 statement claim alongside another claim. If successful, an employee can be awarded two to four weeks’ additional pay (capped at £571 p/w). This means, for example, if in an unfair dismissal claim the employee can show that they were not issued with a compliant section 1 statement, they will receive an additional two to four weeks’ pay. Â

If you have any questions about section 1 statements of employment particulars, please get in touch with our Legal & HR Team on 0141 221 3181 who will be glad to advise.Â

Back to the office update – January 2022

This week will mark a positive step towards Covid-19 restrictions being relaxed in the workplace. First Minister Nicola Sturgeon, announced that Scotland will be taking a more relaxed approach towards working from home, in favour of hybrid working. This decision was made following a decline in Covid-19 cases throughout Scotland in the last week.

From Monday 31st January 2022, a phased return to the office will begin with the “work from home wherever practical†guidance being replaced with a “hybrid†approach. This means employers should arrange for staff to have a combination of both working from home and in the office. Nicola Sturgeon has urged that this shouldn’t be a mass return as this could have a negative impact on the number of cases.

The Scottish Government has acknowledged that not all roles are suitable for a “hybrid†format eg manufacturing. To accommodate different businesses, the government has advised no formal timetable will be provided which gives a date all employees should return. This gives flexibility for employers to follow the guidance in a way that works for their business.

If you need any advice on implementing “hybrid working†then please get in touch with our Legal & HR Team on 0141 221 3181. Members are also invited to join us at our February ‘Breakfast Briefing’ 8:00-8.30 am on the 2nd February 2022, where this topic will be touched upon further.

Coronavirus (COVID-19): Scottish Government Update On COVID Information

COVID-19: Scotland’s move to beyond level 0 (employment implications)

The Health Protection (Coronavirus) (Requirements) (Scotland) Regulations 2021 (SSI 2021/277) came into force on 9 August 2021, revoking Scotland’s protection levels system and allowing all businesses and venues (including those required to remain closed at level 0) to open, with no curfews, gathering limits or physical requirements.

The Scottish Government has substantially updated its guidance to reflect the removal of restrictions and support businesses in adopting measures to mitigate risk. New Precautionary measures guidance, revised Safer businesses and workplaces guidance, and Returning to offices guidance emphasise the need for businesses to take precautionary measures to prevent the spread of the virus. Although social distancing is no longer required, it is still recommended. Masks must be worn in some places and are recommended in workplaces where it is hard to maintain a safe distance. Homeworking is still advised for the current time, but hybrid working will be encouraged in the long term. Advice for people at highest risk guidance advises that those at highest risk can go to their workplace if desired or if required by their employer.

New self-isolation rules for close contacts came into effect on 9 August 2021. Contact tracing guidance states that close contacts who are fully vaccinated, have a negative PCR test result, and no symptoms do not need to self-isolate.

Scottish Government Update On Covid Information

Organisations with ten or more employees can now sign up for asymptomatic workplace testing as part of an enhanced drive to identify emerging COVID-19 cases and break chains of transmission.

The workplace testing offer will initially be until the end of September 2021, in line with the universal testing offer. It will include formal volunteers from third sector organisations. More information is available here.

The Scottish Government has also launched a Beyond Level 0 campaign in line with Scotland’s move past local levels. The campaign encourages everyone to ‘Keep Scotland on track’ during this time by getting two doses of the vaccine, continuing with safe behaviours, and testing regularly. It acts as a reminder that everyone should continue to play their part in keeping Scotland safe.

The Beyond Level 0 toolkit attached includes assets for the overarching campaign and the following pillars:

- Beyond Level 0 – poster and social assets with copy

- Summer Safety Measures – updated poster and social assets with copy

- Asymptomatic Universal Testing – updated social assets with copy

- Symptomatic Testing and Isolation – updated poster and social assets with copy

You can download all Beyond Level 0 Assets here.

Guidance for businesses and workplaces on reducing the risk of COVID-19 and supporting staff and customers has been published.

Self-Isolation Exemptions for Essential Business

Changes are being made to self-isolation rules for close contacts of COVID cases, allowing essential staff in critical roles to return to work to maintain lifeline services and critical national infrastructure.

It will be possible to apply to exempt those who work in critical roles where staff shortages are in danger of putting essential services, such as health and social care, transport and the provision of food supplies at risk.

Exemption will only be granted in respect of members of staff who voluntarily agree not to self-isolate, and the employers’ duty of care to all their employees must be respected.

Strict conditions will apply – staff must be double-vaccinated and in receipt of their second dose at least two weeks previously. They will also require to have a negative PCR test and to agree to undertake daily lateral flow tests. Exemptions will be made on a temporary basis and last only for as long as there is an immediate risk to business or service continuity.

Applications can be made via the Scottish Government website.

If you have any questions please contact us on 0141 221 3181 or by email and we will be happy to help.

Coronavirus (COVID-19): Scotland’s move to level 0

No doubt you will already be aware that, yesterday, the First Minister confirmed that all parts of Scotland will move to Level 0 on 19 July, but with certain modifications to the original indicative plans as a result of the challenges posed by the Delta variant. A summary of the main changes which are likely to affect the manufacturing sector, and which come into force from 00:01 on Monday 19 July, are below:

- Physical distancing indoors will reduce to 1 metre

- 15 people from 15 different households can meet outdoors and will no longer be required to distance from each other – however, each group of 15 people will be required to maintain 1 metre distance from different groups

- Phased return to offices will be delayed until the ‘Gateway condition’ is met (conditional on all adults over 40 protected with two doses of the vaccination and a review of the epidemic being carried out ahead of the date for that move).

- Employers are being asked to continue to support homeworking where possible until we move beyond Level 0

In addition, from 04:00 Monday 19 July, fully vaccinated travellers arriving into Scotland from Amber list countries will no longer be required to self-isolate and take a test on day eight. Adults (and children over 12) will still take tests before travelling and on day two after arrival. Anyone testing positive or experiencing symptoms of COVID-19 will still require to self-isolate for 10 days.

There are no changes to the requirements to wear a face covering or the need to self-isolate for those who are experiencing symptoms of COVID-19, who have tested positive, or who are a close contact of someone who has tested positive.

The First Minister will provide a further update to Parliament the week before the next review date on 9 August.

Further information on what Level 0 means for all sectors is available here and the First Minister’s full speech can be found here.

ScotGov is in the process of updating the COVID-19 Manufacturing Guidance and Operational Checklist. The updated version is due for publication on the Scottish Government website on 19 July.

As always, if you have any questions you can contact us 0141 221 3181, thank you.

Coronavirus (COVID-19): right to work checks

The Home Office has announced that the adjustments to right to work checks introduced during the pandemic have been extended until 31 August 2021.

Home Office guidance has been updated and can be found here.

From 1 September employers must revert to face to face and physical document checks as set out in legislation and guidance. This will ensure employers have sufficient notice to put measures in place to enable face-to-face document checks.

As always, if you have any questions you can contact us 0141 221 3181, thank you.

Updated Manufacturing Sector Guidance (28th June 2021)

The Scottish Government has updated their coronavirus manufacturing sector guidance, and a link to the updated Guidance and Operational Checklist can be found here.

The following sections have been updated:

- Overview, Where We Are Now, Ventilation, Information for People on the Shielding List, Working from Home, Test & Protect, Vaccination, Outbreak Management, Enhanced Hygiene, Face Coverings, Work Cohorts/ Bubbles, Communal Areas and Congestion Points, Car & Vehicle Sharing.

The updates reflect the changing guidance as Scotland starts to move down the COVID-19 Protection levels, re-enforcing best practice and includes new sections with additional guidance worth noting on:

- Ventilation – the provision of fresh air into indoor environments to prevent the spread of COVID-19

- Vaccination – encouraging employers to support workers to attend for vaccination when advised to do so, without any financial detriment.

As always, if you have any questions, you can contact the team on 0141 221 3181, thank you.

Job Retention Scheme and Business Support Schemes

HMRC has issued updated guidance to Employers on the above topic, which is linked here. In summary - Claims for Furlough payments for May must be submitted by the 14th May. For May, you can still claim 80% of salary up to a cap of £2,500. You must make employer deductions to HMRC – failure […]With restrictions easing and infection rates a concern in many areas, COVID-19 testing is more important than ever, The Scottish Government has provided the latest guidance on the need for testing: Lateral Flow Kits Free lateral flow kits are now available to everyone in Scotland for twice-weekly asymptomatic testing, and these will be available for pick […] Member’s Briefing – Returning to work safely

With today’s significant easing of restrictions, the Scottish Government has developed a toolkit to support businesses returning and reopening. Please find attached the Helping your business to reopen safely toolkit. This contains links to posters and digital assets that can be used to promote the latest guidance and regulations to employees and customers. They should […]Members Briefing – Car & Vehicle Sharing

COVID-19: Updated Manufacturing Sector Guidance (8th February 2021)

The Scottish Government has updated the Manufacturing Sector Guidance with an amendment to the advice on car and vehicle sharing and should just confirm the measures companies already have in place.

The following link is to the Scottish Government Manufacturing Sector Guidance:

Coronavirus (COVID-19): manufacturing sector guidance – gov.scot (www.gov.scot)

The main points are:

Employees should be encouraged to avoid sharing a vehicle with anyone from another household unless they absolutely have to. In situations where sharing a vehicle is unavoidable, such as travelling to work:- all employees should be instructed not to use shared transport if they are displaying symptoms of COVID-19 and should stay at home and follow government guidance on self-isolation. Encourage drivers or designated persons to check employees prior to boarding vehicles to ensure those who have suspected symptoms do not travel;

- limit the number of people from another household, ideally no more than 2. This may result in organising more trips with fewer people;

- where possible, restrict car-sharing to groups of people who use the same work area;

- all employees should be advised to wear face coverings in shared vehicles (as required when using public transport, and provided it does not compromise driver safety in any way) and perform hand hygiene before and after leaving the vehicle;

- vehicles should be well ventilated (i.e. by keeping the windows open), and passengers should sit as far apart as possible, with the passenger in the back seat, diagonally opposite the driver and aiming for 2-meter physical distancing between occupants;

- shared vehicles, including minibuses, should be cleaned regularly using gloves, with particular emphasis on handles, buttons, seat belts, and other areas where passengers may touch surfaces.

Full advice on car and vehicle sharing can be found on Transport Scotland website.

The operational guide and checklist also asks to consider whether it is practical to keep a record of those who car share and provides further guidance on managing visitors to premises:

Coronavirus (COVID-19): manufacturing sector guidance – gov.scot (www.gov.scot)

If you have any questions, you can call the team on 0141 221 3181.

The Treasury has issued a direction which formally extends the ongoing CJRS furlough period until the 30th April 2021, an extension of one month.

It also clarifies that the reference period for establishing ‘normal’ pay as a basis for making a payment and claim for these periods should be the corresponding months in 2019, not 2020, as the likelihood is that employees may have been furloughed in March and April 2020.

There are also changes to the claim time period, which is extended from the middle of the following month to the end of the following month.

The full six-page direction can be found here.

As always, if you have any questions you can contact the team on 0141 221 3181, thank you.

Deadlines – Coronavirus Job Retention Scheme

By way of reminder, the CJRS has been extended for all parts of the UK until 31 March 2021. The Government will pay 80% of employees’ usual wages for the hours not worked up to a cap of £2,500 per month. The terms of the scheme will be reviewed in January 2021. Employees do not need to have previously been furloughed to claim for periods from 1 November 2020 onwards.

There are some deadlines to be aware of as follows:-

- In respect of any claims for the period up to 31 October 2020, claims must be submitted on or before 30 November. Claims for that period will not be accepted after this date.

- In respect of any claims up to 30 November 2020, these must be submitted no later than 14 December 2020 whether or not you have run your payroll by that date.

- In general, claims must be submitted within 14 days of the end of the month they relate to.

You should keep any records to support the amount of CJRS you can claim just in case HMRC later seeks to carry out an audit.

For claim periods from 1 December 2020 you may not claim CJRS grants for any days that your employee is serving either contractual or statutory notice, including notice of retirement or the employee’s resignation.

With the imminent escalation of areas in Scotland to the 4th Tier of coronavirus restrictions, members will be aware that these also bring new travel restrictions making it illegal for people in level three or four areas to travel outside their own council area except for “certain essential purposes”, while people in other areas must not travel to level three or four regions.

In respect of this change, Scottish Engineering advises that its view is that travel to work, where there is a justifiable reason for doing so meets the requirement for essential purposes. In doing so we refer to the helpful statement made this Tuesday by Scotland’s First Minister repeating the assertion that “those who can work from home should do so – though unlike lockdown earlier in the year, construction and manufacturing workplaces can remain open.”

We would advise members to follow these guidelines in respect of this change:

- Although construction and manufacturing are specifically mentioned above, other workplaces will have their reasons to be considered essential and businesses should make this evaluation

- You may consider whether some employees can work from home for some or all of the period of enhanced restrictions

- Consider issuing updated letters to staff who do have to travel to work from one local authority to another where these areas are subject to a level three or four restriction. Letter templates are available from Scottish Engineering for this, please reply to this email to request or phone our main number on 0141 221 3181

As ever, we are here to advise members where we can, please contact us by phone or email and we will be happy to help.

On 13 November 2020, HM Treasury published the Coronavirus Act 2020 Functions of HMRC (Coronavirus Job Retention Scheme) Direction. This is the fourth such direction issued by the Treasury and collectively they form the legal framework for the CJRS.

The Direction does the following:

- formally extends the CJRS from 1 November 2020 to 31 March 2021

- sets out how the CJRS will operate between 1 November 2020 and 31 January 2021 – the fifth direction covering February and March 2021 will be published in due course.

- withdraws the Coronavirus Job Retention Bonus.

The main focus of the fourth direction is to address how the CJRS will operate from 1 November 2020 to the end of January 2021. The rules will cover a wide range including eligibility, furlough agreements, claim periods, reference salaries, calculating usual hours of work, permitted activities during furlough, business succession including TUPE, PAYE scheme reorganisations, limits for making claims and publication of CJRS claimants’ details.

Some key points:

- It is now a condition of making a claim that the employer accepts that HMRC will publish information about CJRS claims on the internet (including the name of the employer and a ‘reasonable indication’ of the amount claimed).

- Furlough agreements must be in place before the start of the relevant claim period. While it may be sufficient to update an earlier agreement, this must be done before the employee is furloughed under this phase of the CJRS.

- Importantly, claims may not be made for any period an employee is serving notice between 1 December 2020 and 31 January 2021 – the latest guidance states this covers both statutory notice and contractual notice periods.

Additional UKG Coronavirus support

Dear Member,

As you may have seen, the Chancellor has just made a further announcement on economic support for businesses and people across the UK over the winter months.

Measures announced today which will be of interest to you include:

- The furlough scheme will be extended until the end of March – see previous updates for more detail on this scheme. This is a flexible furlough scheme, to 80% of salary capped at £2500, and employees do not have to have been furloughed before;

- There is a review point in January, which may have the capacity to reduce from 80% as the previous scheme did;

- The Job Retention Bonus of £1000 per retained employee which would have paid out in January 2021 has been scrapped, though a new incentive may take its place next year;

- Guaranteed funding for the devolved administrations is increasing from £14bn to £16bn (bringing the Scottish Government’s guaranteed funding to £8.2bn, on top of their Spring Budget 2020 funding).

This is on top of previously announced support, which included the extension of existing loan schemes to the end of January, and an ability to top-up Bounce Back Loans.

A factsheet with details of the package can be found here, and HMT’s press release can be found here. Fuller guidance will be issued on the 10th December which we will brief.

PPE Contacts List and the use of face coverings – Updated for November 2020

All of our member companies are having to address their responsibilities to provide as safe a working environment as possible in regard to COVID-19 as well as “normal business” hazards. PPE plays a key role in addressing these issues.

We previously supplied a list of companies who are manufacturing and/or supplying PPE. We have also added companies who are offering decontamination services, testing and a CPD certified COVID-19 course, branded face coverings and UV-C Air Sterilisation Products.

- Click here for our updated list of PPE manufacturer/suppliers.

- Click here to view further information about SWGR Decontamination services

- Click here to view further information on Reactec SAFE-DISTANCE technology

- Click here to view further information on Engineering Supply Co (Scotland) Ltd UV-C Air Sterilisation Products.

We kindly ask that you contact these companies directly for further information on detailed specifications or availability. All these businesses are located in Scotland.

The mandatory use of face coverings in canteens & communal areas of the workplace.

Updated guidance from the Scottish Government is on its way. Generally it will require companies to identify areas of the workplace which are work areas, canteen, communal areas (passageways, stairs, training rooms, lift, changing rooms, entrances & any other area where people might gather).

Then consider where face coverings are required to be worn i.e where measures to ensure 2m distancing is not possible.

Consider:

- whether it is practical or appropriate for employees to use their own face coverings in these workplace areas, or whether it is more practical or appropriate for you to supply face coverings for your employees.

- whether these face coverings have to be stored in certain places when not in use, and where these will be stored

- the logistics of employees having to retrieve face coverings, and the possibility of employees having to travel through communal areas, without their face covered, to retrieve these

- how used face coverings will be disposed of or washed safely and hygienically

- using signs which clearly identify each designated workplace area, the rules that apply regarding the wearing of face coverings in each of these areas, and at which point these should be worn

The other addition to the guide will be with regard to temperature checks

The guidance does not recommend the use of temperature checking employees as a means of testing for COVID-19 due to the low efficacy rate of this method.

Update on the Job Support Scheme 23/10/2020

We sent a members brief with summary headlines relating to the new Job Support Scheme. Further details have been issued today (including some more new terminology to understand) which will clarify what scheme may be relevant to you. Click here for the updated policy paper

The schemes will now be known as JSS Open for businesses who are maintaining operations at a reduced level due to the pandemic; JSS Closed for businesses that have been required to close under lockdown regulation.

As we briefed yesterday, Under JSS Open, an employee will need to work at least 20% (no longer 33%) of their normal hours. They will receive normal pay for the hours they work, and two-thirds of pay (which is capped at those earning more than £3,125 a month) for the hours they do not work. For that two-thirds top-up, the government will pay 61.67% (i.e. up to a maximum of £1,541.75 per month) and the employer will pay 5%, plus NI and pension contributions on the full amount. This reduces hugely the burden on the employer. As with furlough, there must be a written agreement between employer and employee agreeing to the proposal.

Under JSS Closed, the position remains that the employee will receive two-thirds of their normal wages, funded by the government (again, with a cap biting against those who earn more than £3,125pm). The employer will have to pay the NI and pension contributions on that amount. Again, there must be a written agreement between employer and employee, agreeing to the changes. This is effectively the furlough arrangement as was previously understood, though at 66% of salary (i.e. up to a maximum of £2,083.33 per month).

Employers can top up wages beyond the amounts provided for in the scheme – the initial view was that employers could not. You are not required to top up beyond the requirements of the scheme. The scheme is focussed on employers with fewer than 250 employees, though larger companies can apply providing they can demonstrate financial hardship caused by the pandemic.

Employers will claim in arrears for salary monies already paid. The first claims can be made from 8 December 2020 (ie 5 weeks after the scheme opens on 1 November) via an online portal, similar to the Coronavirus Job Retention Scheme. Employers cannot claim for an employee who has been made redundant or is serving a contractual or statutory notice period during the claim period. Any roles claimed for need to be ‘viable’. In the absence of further guidance at this point we cannot be assured whether this will apply to notice pay not related to redundancy.

To calculate the amount of pay: for employees who are paid a fixed salary, the ‘Reference Salary’ is the greater of:

- the wages payable to the employee in the last pay period ending on or before 23 September 2020

- the wages payable to the employee in the last pay period ending on or before 19 March 2020, this may be the same salary calculated under the CJRS scheme

For those who receive variable pay, the ‘Reference Salary’ is the greater of:

- the wages earned in the same calendar period in the tax year 2019 to 2020

- the average wages payable in the tax year 2019 to 2020; or,

- the average wages payable from 1 February 2020 (or the employee’s start date if later) until 23 September 2020

Please see the updated guidance at the above hyperlink for the full detail regarding the Reference Salary. We will update further if and when Treasury guidance is of benefit to you. As always, please contact us with any queries on the above.

Update on the Job Support Scheme 22/10/2020

The Government have today announced a significant change to employers benefit in relation to the Job Support Scheme, which will commence on the 1 November 2020.

In summary the changes are:

- Initially the qualifying criteria meant that employees had to work for a minimum of one third of the working week; that figure has changed to one fifth, which for most employers means having to find only one days work per week;

- The make up of the payments has changed to increase the Government support, and to reduce the employers support.  The Government and the Employer previously paid 33% each of the lost wage, with the employee foregoing the remainder. Now, the Government will contribute 61.67%, with the employer contribution reduced to 5%. The Government contribution is capped at £1541.75 per month, with the Employer contribution capped at £125 per month.

There is some detailed information on the enclosed fact sheet here.

Please let our team know if you have any individual questions. Full guidance is expected imminently.

Update on the Coronavirus Job Retention Scheme 19/08/2020

Dear Member,

There are changes happening to the CJRS as from 1 September 2020. As from that date, CJRS will pay 70% of normal wages up to a cap of £2,187.50 per month for the hours which furloughed employees do not work. Members still need to pay their furloughed employees at least 80% of their usual wages for the hours they do not work up to a cap of £2,500 per month, so you will need to top up the difference between this and the CJRS grant.

Please note that the caps are proportional to the hours not worked. For example, if your employee is furloughed for 25% of their usual hours in September you are entitled to claim 70% of the usual wages for the hours they do not work up to £546.88 (25% of the £2,187.50 cap). Members also have to fund furloughed employees national insurance contributions and pension contributions themselves.

As always, if you have any questions you can contact the team on 0141 221 3181 – thank you.

COVID-19 Risk Assessment Update 02/07/2020

Dear Member,

As an employer, you must protect people from harm. This includes taking reasonable steps to protect your workers and others from coronavirus. HSE has publised their updated COVID-19 Risk Assessment advice, which can be viewed here.

For the latest information and advice on the coronavirus outbreak visit their website.

If you have any questions, you can call the team on 0141 221 3181.

Job Retention Scheme Grant Update 29/06/2020

Dear Member,

Find out how to pay all or some of your grant back if you’ve overclaimed through the Coronavirus Job Retention Scheme. You can:

- correct it in your next claim

- make a payment to HMRC (only if you’re not making another claim)

- You’ll need your 14 or 15 digit payment reference number that begins with X

Find out more here.

As always, if you require any support or have any questions you can contact the team on 0141 221 3181, thank you.

Members Briefing – Test and Protect and Phase 1 Toolkits

Dear Member,

We would like to draw your attention to the NHS and Government campaign on test and protect. Attached are the Test & Protect and Phase 1 Stakeholder Toolkits. These are assets for workplaces to help promote awareness and engagement by employers and their employees.

Please feel free to pass these toolkits onto any of your contacts who may benefit from this information. If you have any questions, you can contact the team on 0141 221 3181.

Click here to view Test and Protect info

Click here to view Routemap info

Dear Member,

All of our member companies, whether operational or preparing to return to work, are having to address their responsibilities to provide as safe a working environment as possible in regard to Covid-19 as well as “normal business” hazards.

PPE will obviously play a key role in addressing these issues and, thanks to those member companies who got in touch, we can now provide a list of members within our network who are manufacturing and/or supplying PPE. We kindly ask that you contact these companies directly for further information on detailed specifications or availability. All these businesses are located in Scotland.

- Click here to view updated list of suppliers.

- Click here to view Falcon Hand Sanitiser Station specifications.

- Click here to view WB Alloys specification brochure.

Members Briefing – Job Retention Scheme Clarification

Dear Member,

We wanted to share more widely clarification from BEIS on the changes to the Coronavirus Job Retention Scheme. As stated in the policy notification:

- From 1 July, employers can claim CJRS grant for reduced hours working

- However the scheme will close to new entrants from 30 June.

- From this point onwards, employers will only be able to furlough employees that they have previously furloughed for a full 3 week period prior to 30 June.

- The final date by which an employer can furlough an employee for the first time will be 10 June, in order for the current 3 week furlough period to be completed by 30 June.

To clarify issues raised over the transition of systems:

- Employers will not be eligible from July if they have not previously furloughed their staff, but will be eligible if they have furloughed them previously at any point.

- The individuals do not have to be on furlough in June / on the day of the announcement to be eligible to be furloughed from 1st July, as long as they have been furloughed previously.

- Existing employers can furlough previously furloughed employees after 10th June, which means that furlough period cross into July.

- However they will need to ensure the employee is fully furloughed for three consecutive weeks for any furlough periods that begin in June.

- Once that three-week period has ended, they can use the enhanced flexibility in July.

- All employers will be required to make a claim for the period to 30 June, and a separate claim as required from 1 July.

If you have any questions, you can contact the team on 0141 221 3181

Dear Member,

Many of you will be aware that during a somewhat politically charged period, there has been encouragement to report companies to the Health and Safety Executive for concerns over safe working with social distancing. We know that the reporting level has been substantial, so felt it was useful to share the experience that one company had when being contacted by the HSE in follow up:

- Contact from HSE came at a time when the principle contact could not respond immediately, but the HSE contact was happy to be phoned back as soon as possible

- Principle contact was requested to place themselves at the entrance of the building and walk through the operation describing all the Covid-19 alterations to operations that had been made

- Requested that Covid-19 risk assessment and policies were sent to HSE person at end of call

- Particular and high attention paid to arrangements for toilets including numbers permitted and use of physical markings and barriers to limit numbers and risk

- Canteens, shared spaces and other common touch points also of key interest

- After speaking to principle contact, HSE person asked to speak to responsible HSE person on site, and when this person not available asked to speak to person with surname with random initial letter in order to verify similar answers to questions asked

- It should be noted that the company reported that the HSE professional was fair, balanced and thorough throughout the conversation.

Any member who has been in a situation where MSP’s, MP’s or TU’s have been encouraging employees to use the HSE reporting portal should be aware of this process, and are welcome to contact us for support.

Coronavirus Job Retention Scheme (CJRS) Update

At the end of last week the Chancellor, Rishi Sunak, announced more details about the extension to the Coronavirus Job Retention Scheme (CJRS). HM Treasury have added considerable detail on changes and these can be viewed here.

STATWARS Climate Change Challenge Home learning resources

Member company Primary Engineer have launched their newest project, The STATWARS®: Climate Change Challenge. The vision behind this project is to empower and educate pupils to tackle climate change, by providing a project that delivers meaningful and engaging mathematics, numeracy and data literacy to pupils! For more info on how to register, click here.

COVID-19 Updated Member Best Practice Share

Scottish Engineering has continued to receive excellent best practice examples from across our membership so that we can share advice for continuing operations, or planning to restart where closed.

These have been combined with our Return To Work Webinar guidance from this week into one new document with links to external support materials, decision flowcharts and visual examples to help member companies continue to implement safe social distancing and reduction of infection risk.

Click here to view this information.

Scotland’s COVID-19 Framework for Decision Making

Dear Member

Below is a statement and link to document released by the Scottish Government today relating to the ‘Routemap’ for easing lockdown that was presented by the First Minister in parliament today at 1230.

The Scottish Government has today (21 May) published COVID-19 Framework for Decision Making – Scotland’s Route map through and out of the current lockdown.

This update sets out how and when Scotland might ease lockdown restrictions, based on the framework set out by the World Health Organisation, and takes account of the experiences of other countries as they have started to come out of lockdown. It provides practical examples of what of what people, organisations and businesses can expect to see change over time.

The document is attached and can be found here.

Furlough and Annual LeaveÂ

The UK Government has published further guidance on holiday entitlement and pay during coronavirus. The guidance is straightforward and contains details on the interaction of annual leave with the Coronavirus Job Retention Scheme (commonly known as the “Furlough Schemeâ€). If Member Companies have any questions on this guidance, please do not hesitate to contact the Scottish Engineering legal team on 0141 221 3181.UK Government to support businesses through Trade Credit Insurance guarantee Government is introducing a temporary reinsurance agreement with insurers currently operating in the market to support businesses with supply chains which rely on Trade Credit Insurance and who are experiencing difficulties due to Covid-19 impact. https://www.gov.uk/government/news/government-to-support-businesses-through-trade-credit-insurance-guarantee

Scottish Government Extends Pivotal Enterprise Resilience Fund

Scottish Enterprise and partners have advised that the Pivotal Enterprise Resilience Fund will reopen for new applications from mid-morning on Thursday 14 May 2020. Full details are available here.Digital Briefing – Solutions for Social Distancing The Scottish Enterprise Digital Transformation Team have produced the below attached useful document with suggestions and suppliers for digital tools to aid social distancing, and can help advise on implementation. Click here to view.

Virtual Visits for Members 12/05/2020

Dear Member,

Now we are all getting used to new ways of working, we would like to restart our regular programme of catch up visits with members – which for now will need to be either virtual visits, via MS teams or Zoom, or by telephone call.

If you are keen to have a catch up visit, then please register your interest by clicking on the link below, and we will prioritise arranging a meeting with your organisation. We’d like to hear from as many members as possible. In any event the team will be in touch over the coming weeks and months by email or telephone to try to arrange visits with our regular contacts as we normally do.

Please click here to register your interest. You will find the button to register at the bottom of the page.

COVID-19: Operations Summary and Best Practice Share

Dear Member,

Scottish Engineering contacted a representative cross section of our membership to understand and share a summary of the levels of companies continuing operations, planning to restart where closed, and levels of use of the Job Retention/Furlough scheme.

These results have now been combined with best practice shares received from member companies on the implementation of safe social distancing and reduction of infection risk. Click here to view this information.

Bounce Back Loan and Coronavirus Testing Information

Dear Member

We would like to update you on two pieces of updated guidance and support as follows:

1. Coronavirus (COVID-19): getting tested in ScotlandÂ

The Scottish Government has extended its testing programme to include “Staff and volunteers in third or public sector organisations, and staff in nationally or locally significant industry important to economic sustainability and growthâ€. Reference to this change was made in the First Minister’s briefing on Friday 1st May where she stated “As of now, we are expanding eligibility to include all those over the age of 65 with symptoms and their households, and in addition to keyworkers, anyone – although there should not be many people in this group – who is not a keyworker, but who has to leave home to go to work.â€Â  Guidance on testing eligibility and the online process to book a test can be viewed here.2. UK Government Launches Coronavirus Bounce Back Loan

The new Bounce Back Loans scheme is now open for applications. The scheme allows small and medium-sized businesses to borrow between £2,000 and £50,000 and access the cash within days. The UK government guarantees 100% of the loan and there won’t be any fees or interest to pay for the first 12 months. Loan terms will be up to 6 years. No repayments will be due during the first 12 months. The government has also agreed with lenders that an affordable flat rate of 2.5% interest will be charged on these loans. Businesses can apply online through a short and simple form. You can find further information about the scheme, including eligibility, here.The scheme will be delivered through a network of accredited lenders and will run alongside the existing Coronavirus Business Interruption Loan Scheme (CBILS) and Coronavirus Large Business Interruption Loan Scheme (CLBILS).

Launch of Scottish Government £100m Fund

£100m funds to help business - Applications open for lifeline support schemes.

A £100 million package of additional grant support for small and medium sized businesses (SMEs) and newly self-employed people opens for applications later today. The three separate funds will be administered by local authorities and Scotland’s enterprise agencies and will begin to pay out grants in early May.

They include a £34 million hardship fund for the newly self-employed, a £20 million fund for small and micro enterprises in the creative, tourism and hospitality sectors and £45 million for viable SMEs crucial to the Scottish economy which are vulnerable.

Applicants can access these funds and more via the www.FindBusinessSupport.gov.scot website. All funds will be open for applications by 1400hrs.

Click here to view full information on the support scheme.

As you may have seen, the Chancellor has announced a new loan scheme for small businesses, ‘Bounce Back Loans’:

- Businesses will be able to access these loans through a network of accredited lenders, and will be able to borrow between £2,000 and £50,000.

- The government will provide lenders with a 100% guarantee for the loan and pay any fees and interest for the first 12 months. No repayments will be due during the first 12 months.

- The loans will be easy to apply for through a short, standardised online application.

- The scheme will launch for applications on Monday 4 May.

The Chancellor’s statement is here, the press release is here and further details will be available here.

In addition, HMRC has published detailed guidance on reporting payments in PAYE Real Time Information from the Coronavirus Job Retention Scheme, which can be found here.

As always, we’re here to support you as best as we can. If you have any questions, contact the team on 0141 221 3181. Thank you.

Scottish Engineering Breakfast Catch Up Webinar

During these strange and isolating times, it is easy to feel anxious or upset. With the world weathering the coronavirus storm, it has never been more important to savour some more upbeat moments in our working day.

So please join our Zoom link for our Scottish Engineering Breakfast Catch Up on the morning of Friday 1st May – its BYOB (and we mean breakfast not bottle). The aim of this online session is to give our minds a break from stress and worry for a little while, and to instead focus on the fantastic stories of our wonderful guest speakers. They’ll discuss their careers, the challenges they’ve overcome and where they are in life now, and if there is time we’ll have a short Q&A session.

Click here for full information on how you can register.

Job Retention Compensation Scheme

As briefed the portal to lodge claims opened on Monday.

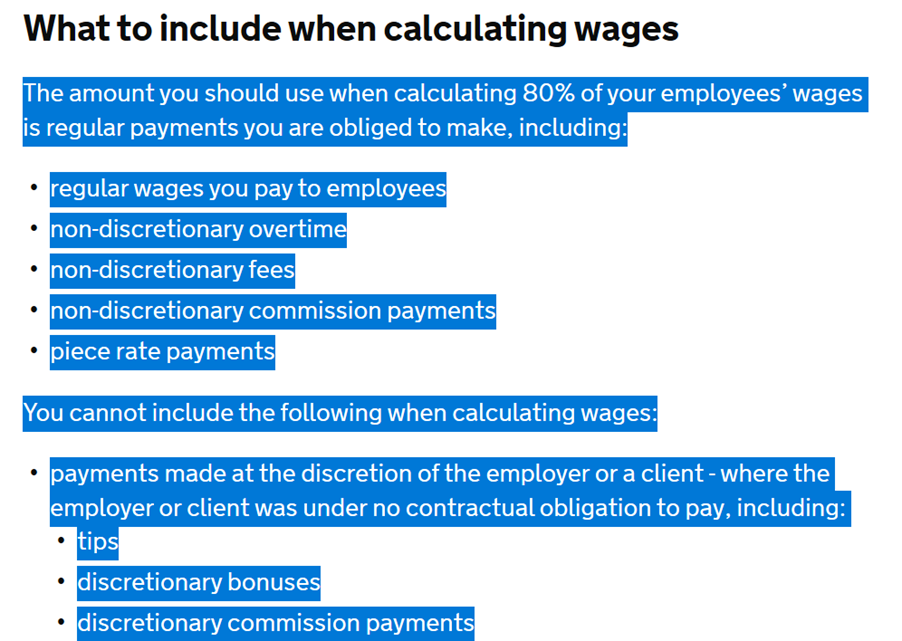

We wanted to draw your attention to the ‘What can be claimed’ section of the revised guidance.

Previously the guidelines contained reference to ‘past overtime’ which could form part of the claim whether discretionary or not and the broad interpretation was that ‘guaranteed overtime’, as used in holiday pay claims was to be used.

It is our view based on the above revision that the only overtime (and other payments noted) that should be paid and claimed is that which is contractually mandated – i.e. there is specific reference to a requirement to work overtime in an employment contract or statement of terms. This may require you to change your payment and potential claims accordingly.

Full guidance can be viewed here.

Personal protective equipment (PPE) Supply

We have been contacted by members and external bodies keen to help with the supply of essential medical PPE for NHS and the Care Sector in Scotland. Companies who have capability or are interested to help with this are advised in the first instance to contact Covid-19NHSsupplychain@gov.scot to express interest.

We are advised that although coordination of supply is managed separately for Scotland and England, advice and specifications are essentially the same, so interested parties may find the following links shared by BEIS useful.

The UK government has launched a new hub containing guidance on personal protective equipment (PPE), and infection prevention and control (IPC), containing information for both health and social care settings and other workers and sectors.

The hub also links to the Cross-government UK-wide PPE plan to ensure that critical PPE is delivered to those on the frontline. This includes a new ‘Make’ strategy of encouraging UK manufacturers to produce PPE. We would welcome support from manufacturers who wish to offer their production facilities where they can meet the required specifications for use by the NHS and care sector. New offers can continue to be made via www.gov.uk/coronavirus-support-from-business.Thank you.

Updated COVID-19 Advice 14/4/2020

Dear Member,

In this brief we’d like to share useful information issued by the Department for Business, Energy and Industrial Strategy on coronavirus (COVID-19). All coronavirus business support information can be found at gov.uk/business-support.

Coronavirus Business Support Hub

- A new Coronavirus Business Support Hub is now available at gov.uk/business-support which provides key information for businesses including funding and support, business closures and your responsibilities as an employer and managing your business during coronavirus.

New Updates and Guidance

- Temporary changes to the Statutory Residence Test. The Chancellor of the Exchequer has proposed a change to the tax legislation to allow highly skilled individuals from across the world to come to the UK and help us respond to this unprecedented health emergency. The Statutory Residence Test (SRT) will be amended to ensure that any period(s) between 1 March and 1 June 2020 spent in the UK by individuals working on COVID-19 related activities will not count towards residence tests that potentially bring global earnings within the purview of UK taxation. These changes are time limited and will only support those people whose skillsets are currently required.

- Notice to exporters 2020/10: processing licence applications during coronavirus (COVID-19)Â The Department for International Trade has revised arrangements for processing licence applications during the coronavirus (COVID-19) outbreak. Find out more here.

- Notice to exporters 2020/09: Export Control Joint Unit updates guidance on compliance checks for open licences. Details of changes and further clarification on compliance checks for open licences.

Updated Guidance on the Coronavirus Job Retention Scheme

The government has issued the third version of the advice relating to the Coronavirus Job Retention Scheme which can be found here:

The main changes can be summarised as follows:

- Employers can now switch employees between sick pay and furlough, although this should not be used to top up small amounts of SSP for short duration absences, which may be regarded as an abuse.

- Further clarification that employers can furlough ‘shielding’ employees and do not require to pay this group sick pay

- Employees with certain work visas will not be regarded as in breach of their visa conditions if they receive funds under the scheme, as any grant under the scheme will not be treated as access to public funds

- Employers can claim in respect of employees who TUPE transferred on to their payroll after 28 February

- The NI and pension contributions which can be reclaimed relate to the furloughed salary, not normal salary

- Employees cannot work for organisations that are linked to their employer while furloughed

- Businesses that engaged in payroll consolidation schemes after 28 February can place employees on furlough leave

- No part of the reclaimed money can be used to fund benefits – it must be paid to the employee in its entirety with no deductions

Separately:

- The online portal via which employers will require to make their claims is due to open on 20 April, and the aim is for employers to be paid within 4 – 6 days of submitting their claim.

- Employers will be able to claim 14 days before payments are due to employees

- New operational guidance will be published soon to help employers to have their claims ready to upload once the portal opens

- The guidance will be further reviewed if feedback from stakeholders and employers indicates this is necessary, as the intention is that this will operate on a fully “self service†basis.

Updated COVID-19 Advice 8/4/2020

1. Coronavirus Job Retention Scheme

Due to the issue of revised government advice and ACAS advice on the Coronavirus Job Retention Scheme in recent days, we are now able to offer some tentative advice in certain areas, including:

- Holidays during furlough leave; and

- Particular categories of employee and whether they can be placed on furlough leave

Click the links below for this tentative advice –

Furlough Leave – special categories

Holiday and Furlough leave advice

2. UK Government Guidance on Work Practices

The Department for Business, Energy and Industrial Strategy have issued more detailed guidance on work practices. There is no change to the UK policy of who can work vs not, but rather some more information on the practical steps employers can take.

General principles and guidance for employers and businesses are here

Sector specific guidance on social distancing in the workplace is here, including a useful guidance for manufacturing

Coronavirus Statutory Sick Pay Retention Scheme (CSSPRS)

This scheme will allow employers who have less than 250 employees to cover the cost of paying SSP in connection with COVID-19 to employees. Online guidance has been published by HMRC, the details of which are summarised below.

HMRC is currently working to set up a system to allow employers to claim reimbursement. Details of when the scheme can be accessed and when employers can make claims will be announced in due course.

Details of CSSPRS Scheme

- CSSPRS will repay employers the current rate of SSP paid to current or former employees for periods of sickness on or after 13th March 2020

- employers can only reclaim the current statutory amount

- the repayment will cover up to two weeks starting from the first day of sickness if:

- an employee cannot work because they either have coronavirus; or

- Â cannot work because they are self – isolating at home

- a fit note is not required to make a claim

- an employee in respect of whom the claim is made must have been on the payroll by 28 February 2020

Records

Certain records must be kept by employers for at least three years following claims being made, including:- the reason the employee could not work

- details of each period the employee could not work, including start and end dates

- details of the qualifying SSP days when an employee could not work

national insurance numbers of all employees you have paid SSP to.

Click here for full Government guidance.

Updated Information on the Furlough Scheme

You may have seen that the Government has issued some new information on the furlough scheme – some of which confirmed what we knew, clarified what we thought, and some of which is new information;

- Employees can start a new job when on furlough, meaning that they may end up earning 80% of salary from one employer, and 100% of a new salary. Whilst not explicitly prohibited in earlier guidance, it is now expressly allowed. This means that employees you have furloughed can work elsewhere during that period, unless your contract forbids it.

- Employees who are unable to work because they have caring responsibilities resulting from coronavirus (COVID-19) can be furloughed. For example, employees that need to look after children can be furloughed.

- An employer can claim back 80% of compulsory – which we presume means contractual – commission as well as basic salary from HMRC from past sales.

- Employers cannot claim back for non monetary benefits, e.g. value of health insurance or a car.

- Directors of a Company can be furloughed and can maintain directorial responsibilities in line with their responsibilities under the Companies Act, but no other work for the Company.

- Employees can be furloughed many times, as long as the period of each furlough is not less than three weeks; so an a employee could be furloughed for three weeks, work a week and be re-furloughed. The only apparent limiting factor is that each furlough period must be for a minimum of three weeks.

- Employers must notify their staff in writing confirming their furloughed status, which would include if un-furloughed and re-furloughed.

- There is as yet no express detail on whether taking annual or statutory holidays might break a furlough; that said, if the opportunity exists to un-furlough and re-furlough, then provided the three week stipulation is maintained it may be permissible. We continue to await absolute clarification of this point.

- Apprentices can be furloughed as previously advised – however any work training undertaken must be paid at apprentice minimum wage rates.

- Administrators can access the Job Retention Scheme provided there is a reasonable likelihood of rehiring the employees

- Those shielding in accordance with public health guidance can be furloughed and so can anyone who is staying off with anyone who is shielding who can’t work from home, as an alternative to making them redundant

- Claims can be made under the scheme for enhanced maternity, paternity, adoption or shared parental pay – which seems to suggest that you can be on mat leave, etc and be paid SMP but also be furloughed for the extra contractual element.

The full details can be found here. https://www.gov.uk/guidance/claim-for-wage-costs-through-the-coronavirus-job-retention-scheme

As always, we remain available to deal with queries on this from our members.

Coronavirus: Urgent Ventilator Parts Request

Dear Member,

We have been contacted by CBI to extend an appeal to our wider network to ask if you, or a company you know can help with this urgent requirement to support ventilator manufacture next week.

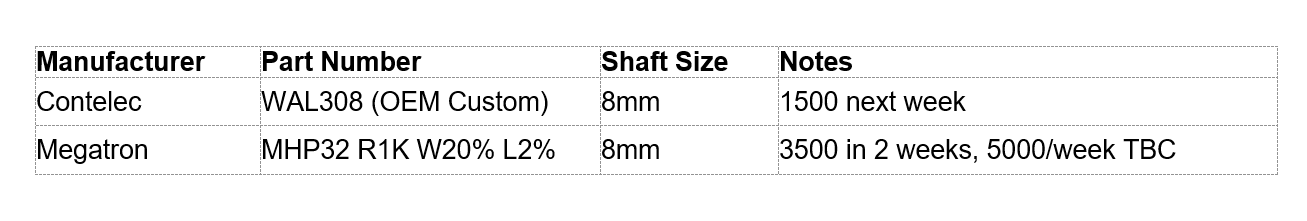

Rotary Pot – Contelec or Megatron

We are struggling to find 5,000 units for next week of the two below options (5,000 of either spec or a combination even would be considered) If you find an alternative we are open to investigating if it will work with our design.

If you find an alternative we are open to investigating if it will work with our design.DC Power SupplyÂ

Limited stock available and lead times require 3 weeks for this particular model.

Contact:Kevin Hallas, KTM ‑ Manufacturing

07964Â 562593

kevin.hallas@ktn-uk.org

Many of you may be aware of the ongoing generosity of Scottish businesses in the donation of PPE equipment to the NHS, and a member in Central Scotland has been in touch to share how their offer to donate available PPE has been warmly received by the NHS Board they contacted. Wider supply chain efforts to ensure frontline NHS staff have enough safety equipment to see them through the coronavirus outbreak are being led by Scottish Enterprise, but in this case every offer of equipment available now may help.

If you have FFP3 or FFP2 type face masks or something similar to the masks below, these would be ideal. Our member company had donated Alpha Solway 3030V, 3M 8833 type masks and we know that Type 2R surgical masks like the far right image would also be welcomed.

Below is the link to the 14 regional NHS Boards across Scotland. Each region has their website and contact details linked to give you a better idea of where you could donate. https://www.scot.nhs.uk/organisations

Your local NHS Board may have specific other PPE requirements that you could help with by contacting them.

We thank you for your support.

Working From Home HSE Guidance

With many of the workforce now working from home, as an employer, you have the same health and safety responsibilities for home workers as for any other workers.

HSE have put together some helpful guidance to aid and improve the way we’re working from home. Click here for full info.

Holiday Amendment Regs

The Working Time (Coronavirus)(Amendment) Regulations 2020

The government has announced it will permit workers to carry over up to four weeks annual leave into the next two leave years (EU leave). The additional 1.6 weeks statutory leave are not covered by these Regulations although this can be carried over for up to a year by agreement under existing legislation. This has been achieved by amending Regulation 13 of the existing Working Time Regulations, and allows workers to carry over the EU leave where it is not practicable for them to take some or all of the holiday they are entitled to, due to coronavirus.

This will allow employers under particular pressure from the impact of coronavirus some flexibility to better manage their workforce but still protecting workers right to paid holiday. There is a link to the government announcement below. The Amendment Regulations are still to be published. Scottish Engineering will update members when more information becomes available.

Click here for government announcement.

Chancellor Coronavirus Announcement

Dear Member,

HM Treasury has shared the following updates:

The UK Government has published further guidance on the Coronavirus Job Retention Scheme: this has now been published here.

You may have seen yesterday the Chancellor announced a further package of Coronavirus support, focussed on supporting the self-employed. Details of the SEISS can be found here. Details on all UKG Coronavirus business support measures can be found here, and Scotland specific information is here.

Furlough Leave Letter Template

The Government has announced a mechanism whereby, where companies or employers are considering redundancy or other job losses, the Government will provide up to 80% of their wage, capped at a rate of £2500.

As yet, we don’t have all of the details of the scheme. Members’ will be updated as these become available. At present, it is unclear whether any reason other than avoiding redundancies will entitle employers to claim on the scheme (although other options have been included in the draft template, eg. following public health advice).

Click here for template.

COVID-19 Update – 24th March 2020

Dear Member Company,

Many of you will have watched the announcements by the UK Prime Minister and Scottish First Minister yesterday evening and have further questions about your businesses. The UK Government Department of Business, Energy and Industrial Strategy has clarified this morning that their advice to Business is as follows:

- If it is impossible for you to work from home, you are able to go to work. For example, this will apply to those who do manual labour, such as in the construction and manufacturing industries, as well as those who provide services that cannot be done from home.

- You are able to go to work if you absolutely have to, unless you are a vulnerable member of society, in which case we urge you to stay at home as per the guidance.

In addition, based on our interpretation of latest Government Advice, this here is the view of Scottish Engineering on 24 March 2020:

- There is no blanket closure of Scottish businesses, other than those specifically highlighted beforehand, e.g. gyms, restaurants pubs & clubs.

- Those who can work from home should do so. Those who cannot work from home can go into work.

- Those who do come into the workplace should observe social distancing guidance or minimise closer contact where not possible.

- Train staff in good hygiene and minimise contact, particularly where social distancing is not possible.

Please click here to refer back to our previous Scottish Engineering briefings on self-isolation and sick pay.

Your FAQs Answered on COVID-19

This brief aims to answer some of the questions that are most commonly being asked of us this week. Answers will reflect our view of the legal minimum, but employers are free to operate better, but not worse arrangements.

There are a number of considerations that employers should be aware of, such as:

- People are advised not to attend GP practices but to diagnose themselves or via NHS 111. This means that getting medical certificates may prove difficult or impossible;

- There is a concern that people may take advantage of the ongoing situation, but it is difficult to see how this can be avoided – proving it may prove problematic;

- Companies are considering their arrangements for contractual sick pay if it is in place – please contact our team if you are;

- Any testing regime which you seek to put in place – temperature checks etc. – need consent to be undertaken.

- We have separate briefs on reducing staff and COVID in general.

FAQs

How do I deal with the following employees who are:

Staying at home to look after children who can no longer attend school due to the school shutdown?

This is likely to qualify for dependent leave for the time that they are required to look after children and is unpaid, and effectively without limit of time. Employers could consider alternatives to unpaid leave such as changing working patterns to help make short term arrangements, using leave etc.

Self Isolating with no symptoms and not working from home?

This would be unpaid or holidays, unless if they are self isolating because a family member is showing symptoms when they would be entitled to SSP. The period of self isolation is 14 days.

Self Isolating with no symptoms but working from home?

This would be paid as normal for the time worked.

Self Isolating due to being in a vulnerable group and therefore not working?

This should be paid as SSP or holidays.

Self Isolating due to being in a vulnerable group and working from home?

This would be paid as normal for the time worked.

Staying at home because of a family member and not working?

This would either be unpaid or holidays. If family member is showing symptoms then SSP would apply. If family member unwell for any other reason the unpaid time off for dependents process would apply, or holiday as the employee prefers. If staying at home because family member is in a vulnerable group but showing no symptoms would be either unpaid or holidays.

Staying at home because of a family member and working?

This would be paid as normal for the time worked.

Relevant COVID-19 Information and Advice

As in previous briefings, the best information we can provide is to check NHS Inform and other reputable sources of public health information.

The update from the Government in the days past indicated a direction of travel, but not necessarily absolute clarity on the steps we need to take today. As you can imagine, any update can be overtaken by events pretty quickly as the situation evolves.

The Government has announced measures that we should all take which are:

- Everyone should avoid gatherings with friends and family, as well as large gatherings and crowded places, such as pubs, clubs and theatres

- People should avoid non-essential travel and work from home if they can

- All “unnecessary” visits to friends and relatives in care homes should cease

- People should only use the NHS “where we really need to” – and can reduce the burden on workers by getting advice on the NHS website where possible

- By next weekend, those with the most serious health conditions must be “largely shielded from social contact for around 12 weeks”

- If one person in any household has a persistent cough or fever, everyone living there must stay at home for 14 days

- Those people should, if possible, avoid leaving the house “even to buy food or essentials” – but they may leave the house “for exercise and, in that case, at a safe distance from others”

This is not lockdown as it has been implemented in some other countries however – specifically, attendance at work is nor precluded by the above measures, but we should always fall back on reducing the risk to those vulnerable. It looks unlikely that staff who have symptoms, and potentially even the virus will be able to provide medical certification in line with your own expectations or policy, therefore you as an employer will need to be pragmatic.

It’s clear that these measures and their effects will have a significant effect on the economy and our members.

It may also be that we are not able to shield our employees from the financial impact on the potential downturn in business created by these measures and the lack of economic activity, so please see our separate briefing on Lay offs and Short Time Working and Redundancy.

Dealing with reductions in work – Lay Offs and Short Time Working

Being realistic, the impact of the measures taken by the Government in relation to Coronovirus and the impact of the lack of economic activity is likely to lead to exceptionally difficult times for most companies. The Government has released details of measures designed to maintain economic activity, but it is clear that we will need to consider how we react as employers to reductions in orders, work, activity and confidence.

In such circumstances, companies are bound to consider what steps they will take in relation to staffing. It seems likely that this situation will not be over quickly – whilst the numbers of new people with the virus are reducing in China, our strategy is to delay such that the impact is lesser, but lasts longer.

We have outlined a range of steps which companies can consider based on the impact, or likely impact of the situation.

- Short Time Working

Short Time Working is where employees work shorter hours and consequentially lower pay, officially lower than 50% of their normal weekly earnings

However, in order to reduce pay, you will need to ensure that there is either a contractual clause – and this is not always the case – or to do it via agreement with your employees collectively if that is how pay is determined, or individually if not.

In lieu of salary, the employer makes a relatively token payment of £29 (increasing to £30 from 6 April 2020) for each non working day, entitled Guaranteed Minimum Pay. So, in basic terms someone normally working a five day week who works on a short time two day week, they would receive two fifths of salary plus £29 for the missed days.

Guaranteed Pay, no matter the length of the Short Time Working period is paid only for the first 5 days of missed work in any 3 month period, so a maximum of £145. An employer can of course pay more than that and for a longer period, but this is the statutory minimum.

If Short Time working continues for either of 4 weeks continually, or for 6 weeks in any 13 week period (with no more than 3 in a row), staff are entitled to apply for redundancy if their weekly earnings are less than 50% of their normal earnings.

It is vital if you are considering it that we outline clearly to staff the reasons behind it – and I think given the circumstances all will be aware of the context – and consider any and all alternatives; using leave, unpaid leave etc.

We have a full practice note which cover al eventualities if you move to Short Time Working, such as consideration of sickness pay and other statutory benefits; if this is something you are considering and would like a chat on it, please contact one of the legal team.

- Lay Offs

Laying people off is essentially standing them down from any and all work for a period of time, but short of dismissing on redundancy. Lay Offs occur normally when there is serious but relatively short term impact on the ongoing operation of a business – a fire or flood for example. Similar rules apply as to when you can operate lay offs – with contractual provision (collective or in individual contracts) or if you can demonstrate that such practices are common place within your organisation. If they do not apply, then it would need to be an agreed change of contractual terms with the employee. Similar rules apply as to the employers right to claim redundancy if the situation carries on over a period of time as above.

- Redundancy

Redundancy is when work of a type diminishes to an extent that the employer needs to reduce their workforce by dismissing staff. There are a number of procedural steps to take prior to any dismissals, which are in broad terms:

- Inform: Staff at risk of redundancy should be formally informed of the reasons behind that, which could be a change in business focus, reduction in order or any other organisational or economic factor which means that it is envisaged that fewer roles are required. At this stage it is ‘roles’ that are at risk, not necessarily people and any discussion should focus on that.

- Consult: It is a requirement for employers to consult with staff on potential for redundancy, either individually or collectively. If you have union representation then consultation will normally happen with representatives from Trade Unions; if not, then there is a process to allow staff to select and vote for employee representatives who will represent them during the process. Many companies offer a mix and match approach, with some collective meetings and at least a couple of meetings with individuals – more if they are required or requested. There are rules regarding length of consultation relating to how many people you are making redundant – If more than 20, then the period should be a minimum of 30 days, more than that is 45 days. There is no minimum period for numbers less than 20, but it should be reasonable and fair and allow them the opportunity to discuss all that they need to do, and for you to consider all appropriate alternatives.

- Select and Confirm: By fair means you will select people for redundancy – competence, skills etc. if there are not alternatives roles or patterns that reduce or negate the need for the roles to be reduced. There are rights to appeal both selection for redundancy and any dismissal by reasons of redundancy.

Please discuss any of these requirements with our legal team who will guide you through these processes, or with any other advice during this time.

COVID-19 Information and Advice

With the rapidly changing nature of the current COVID-19 situation, we want to assure you that we are taking all measures to ensure the well-being of our staff and members, and aim to provide you with the latest government advice and helpful information.

https://www.gov.uk/government/topical-events/coronavirus-covid-19-uk-government-response

Business Support

- Businesses should read and follow the online guidance for employees, employers and businesses. If you have a query that isn’t covered by this guidance you can contact the Business Support Helpline on: 0300 456 3565

- The Small Business Minister and Small Business Commissioner are calling on the UK’s big businesses to speed up payments to their small business suppliers wherever they can to ease COVID-19 related cash flow issues. You can find more information here.

NEW and Updated COVID-19 industry guidance